Reasons Why You Need Bookkeeping Services

Untrained observers may assume that bookkeeping is an easy task that can fit into any schedule or that it can be done on your own using bookkeeping software if necessary. However, for small business owners, keeping an eye on expenses and receipts is critical to gain the best outcome, solvency, and time-sensitivity. This brings us to the reason your business might benefit from hiring an external bookkeeper.

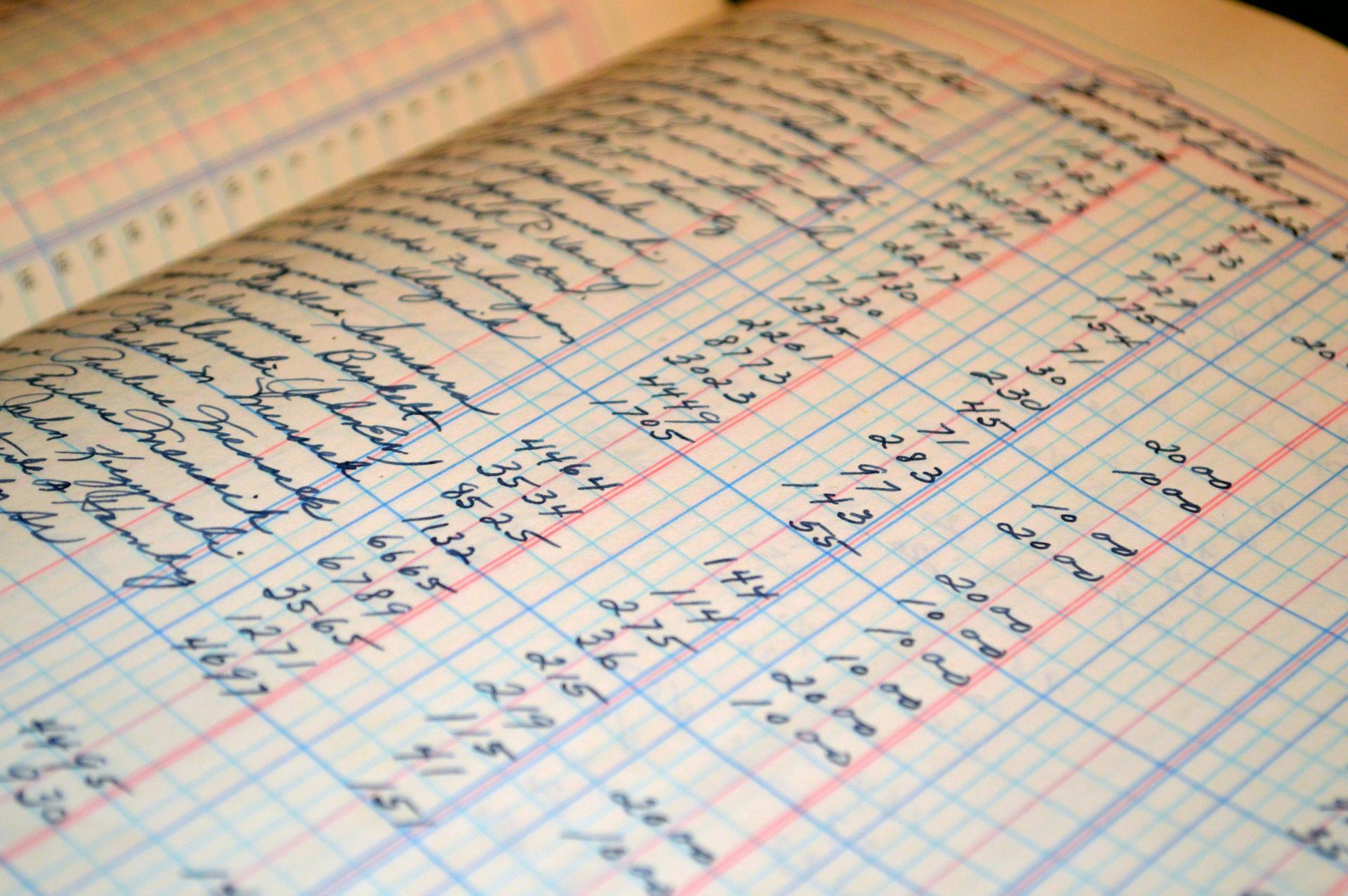

Financial Accuracy and Precision

Achieving exact financial accuracy is critical to the success of any enterprise. Inaccuracies of any size in financial records can have serious consequences, such as compliance problems and poor decision-making. Financial statements can contain errors that spread, making it difficult to determine the true financial health of a company. This is where having a professional bookkeeper on staff is essential.

A skilled bookkeeper ensures that every transaction is appropriately recorded and classified by paying close attention to every little detail. They keep things in order so that there is less of a chance for mistakes, inconsistencies, and oversights.

Their proficiency with financial software and regulations allows them to maneuver through intricate financial environments with ease. A professional bookkeeper protects against errors and offers trustworthy data that supports strategic planning and well-informed decision-making through routine reconciliation and error checks.

Time-Saving and Efficiency

Efficiency and time management are essential in the fast-paced business world of today. It can be difficult for managers and entrepreneurs to devote enough time to financial management because they frequently juggle multiple responsibilities. A competent bookkeeper simplifies financial procedures by using their knowledge to manage data entry, reconciliations, and reporting quickly and precisely. They provide business owners with valuable time to concentrate on strategic initiatives and core operations by effectively handling these tasks.

Furthermore, the proficiency of a professional bookkeeper with contemporary accounting software enhances workflow, minimizes human errors, and guarantees prompt payment of financial commitments. This knowledge plus technology boosts overall operational effectiveness and saves time, which helps a business expand and succeed.

Compliance with Tax Regulations

Overcoming the difficult terrain of tax laws is an obstacle that each and every company has to face. Penalties, legal complexities, and reputational harm result from breaking tax laws. A skilled bookkeeper ensures that financial records are precise and well-organized for tax reporting purposes by keeping up with the most recent tax laws and regulations. They keep careful records that can withstand audits, track deductions, and organize spending.

Businesses can save money by working with an experienced bookkeeper, take advantage of tax deductions, and file accurate and on-time tax returns. This protects the company's finances and gives stakeholders peace of mind, enabling the business to grow without perpetual concern about possible tax-related pitfalls.

Detailed Financial Reports

Financial reporting that is thorough and organized is essential to efficient company management. A company's financial performance and position must be accurately understood in order to make decisions and set itself up for future growth. A competent bookkeeper has the know-how to gather and display financial data in an easy-to-read manner. They produce thorough financial statements that give a thorough picture of the state of the business's finances, such as balance sheets, income statements, and cash flow reports.

These reports function as a guide for evaluating profitability, spotting trends, and figuring out where to make improvements. These reports are a valuable tool for stakeholders and business owners to monitor progress, assign resources, and formulate strategies based on current and accurate financial data.

Better Financial Decision-Making

Making well-informed financial decisions is essential to success in the fast-paced world of business. All decisions, including how to allocate resources and make investments, depend on reliable and insightful financial data. This is where a professional bookkeeper's experience comes in handy.

A competent bookkeeper turns unprocessed financial data into understandable insights. They provide thorough reports, emphasize key performance indicators, and provide insightful viewpoints on the state of the business's finances. Owners of businesses can use these insights to help them make decisions that are in line with the objectives of their organization.

Businesses can confidently strategize for growth, navigate obstacles, and seize opportunities that lead to sustainable success when they have a clear understanding of cash flow, revenue trends, and expenses. A professional bookkeeper can help business leaders steer their enterprises toward prosperity by improving the accuracy and relevance of financial information.